GST Refund in M GST Refund in 1250 MYR. This 6 can be claimed.

Deloitte Online Tools For Covid 19 Tax And Fiscal Measures Deloitte China Tax Services

You should only claim input tax in the accounting period corresponding to the date of the.

. Conditions for Claiming Input Tax. The customs argument was that the GST Repeal Act 2018 stipulates that ITC refund must be made within 120 days from the appointed date and thus the taxpayer was out of time. This Industry Guide is prepared to assist you in understanding the Goods and Services Tax GST and the related Tourist Refund Scheme TRS.

Overview of Goods and Services Tax GST GST is a multi-stage tax on domestic consumption. Eligibility for the Tourist Refund Scheme. The taxpayer was awarded the ITC refund with 8 interest running from.

Input tax credit is introduced to help to eliminate the cost cascading effect of the pre-GST tax regime. As a tourist visiting Malaysia how to claim a refund of GST paid on eligible goods purchased from an Approved Outlet. The procedure however is subject to information given in ITRF as well as the submission of supporting documents if required for review.

On the delayed refund due to an order of authority or court. Directly follow up with the Customs officer to check on the refund status 1. A recent decision by Malaysias High Court in LDMSB v.

When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax. The two reduced SST rates are 6 and 5. As a business the conditions and eligibility.

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. Visit your Customs office in person to follow up. If you have less than RM300 you cannot claim the GST.

So abide by the GST refund dates as. Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted manually. The store employee must fill out a special form at the time of purchase.

The IRBM Clients Charter sets that tax refund will be processed within 30 working days after e-Filing submission. This means you can claim a refund online using your registered GST account anytime within two years from the relevant date. Within 90 working days after manual submission.

Its president Tan Sri Soh Thian Lai said the reimbursement of the outstanding amount based on. If the claim is legitimate the refund must be approved within 60 days of the claims receipt date. This guide will explain to you.

Any refund of tax may be offset against other unpaid GST customs and excise duties. You are entitled up to 3 same-day receiptsinvoices from shops bearing the same GST registration number. A minimum of RM300 in a single receipt.

The term Input Tax Credit ITC is one of the features or mechanisms of Goods and Services Tax GST. Ketua Pengarah Kastam Anor 17 June 2021 unreported as yet allowed the taxpayer LDMSB a refund of an input tax credit ITC in relation to the former goods and services tax GST as a refund of tax overpaid or erroneously paid. As a tourist visiting Malaysia how to claim a refund of GST paid on eligible goods purchased from an Approved Outlet As a business the conditions and eligibility requirements to become an Approved Outlet.

It applies to most goods and services. The tourist can then claim a GST refund from an Approved Refund Agent when the tourist leaves Malaysia by air mode from one of the Approved Malaysian Airports. Some RM78 billion of outstanding refunds for the Goods and Services Tax GST have yet to be repaid to taxpayers causing cash flow of businesses to be negatively impacted said the Federation of Malaysian Manufacturers FMM.

How To File TCS Return Online Under GST TCS Return Online in HindiHow To Claim GST TCS Online Seller Kaise TCS Crdeit GST Return Karegstreturnfiling gs. TRS is a scheme that allows tourists to claim GST paid on eligible goods purchased from an Approved Outlet in Malaysia. GST refund overview in Malaysia.

Many of the above often occur in companies which do not have a designated tax team or structure to manage tax matters or communication from authorities. A 6 interest rate will be charged on the refund that was withheld. Tourist travelling in Malaysia can claim GST back from approved stores.

In other words there is no cost cascading effect under the regime of GST because most of the taxes are combined into a single tax. You have to spend at minimum 300 MYR inclusive of GST equivalent to 70 USD in order to be eligible for tax refund. The applicant must submit GST refund claims within two years after the pertinent date under the GST regulations.

The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting. Tourists classified under the TRS are foreign tourists who are. You can claim the input tax incurred when you satisfy all of the conditions for making such a claim.

However the relevant date differs based on the condition of your claim. The High Court decision is potentially. As a tourist in Singapore if you make any purchase of more than S100 including GST at participating shops you may claim a refund on the 7 Goods and Services Tax GST paid on your purchases.

KUALA LUMPUR Feb 6. The High Court ruled that customs had erroneously rejected the taxpayers claim for an ITC refund. A recent decision by Malaysias High Court in LDMSB vKetua Pengarah Kastam Anor 17 June 2021 unreported as yet allowed the taxpayer LDMSB a refund of an input tax credit ITC in relation to the former goods and services tax GST as a refund of tax overpaid or erroneously paid The High Court decision is potentially controversial as claiming an ITC.

For this your passport required so make sure you have it at hand or keep a copy on your phone. To simplify the process of GST refund the income tax authorities have translated it into an online process. Have not received your Tax Refund.

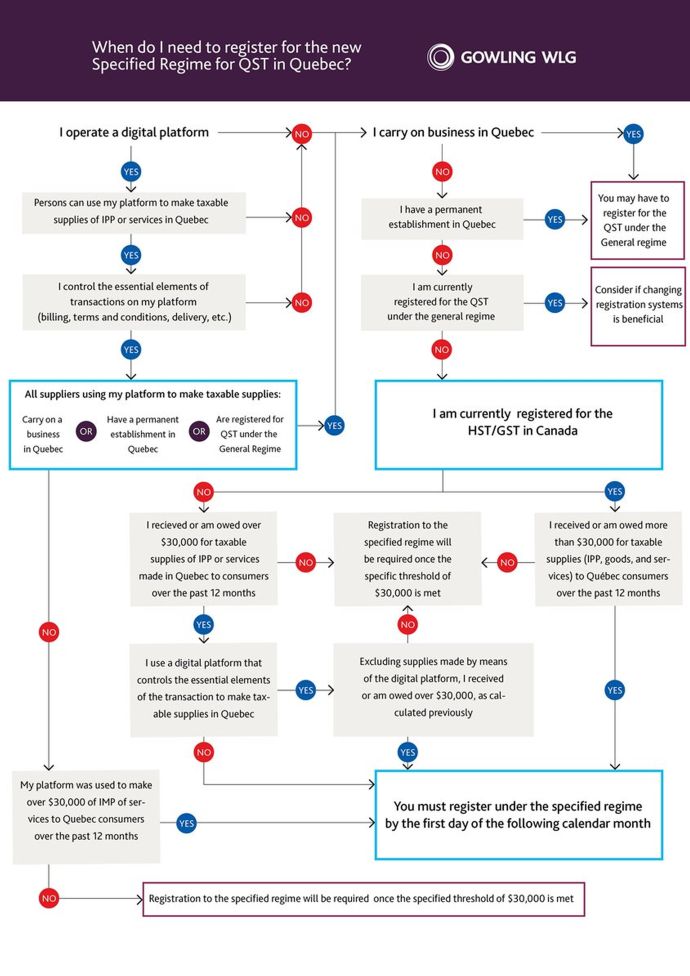

Where To Find Highest Tax Refund For Dior Bag Bragmybag

Australia Hotel Quarantine You Will Pay 3000 5000 Returning Home Here Are State Details

What You Need To Know About Air Canada S New Refund Policy For Covid 19 Cancellations

Personalized Acrylic Calendar For Wall 7 Week Design Ll Dry Erase Board Weekly Planner Clear Acrylic Office Decor 03 007 010

The 13 Latest Tax Refund Scams To Beware Of 2022 Update Aura

The 13 Latest Tax Refund Scams To Beware Of 2022 Update Aura

Working Out Your Gst Return Gst Guide Xero Sg

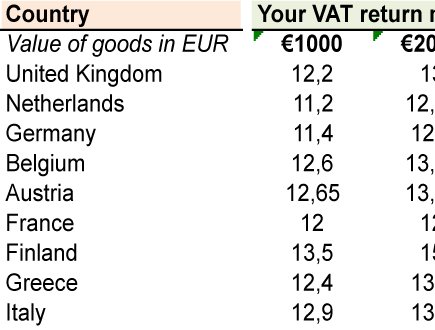

Duty Free Tax Refunds Visitkorea

Working Out Your Gst Return Gst Guide Xero Sg

Where To Find Highest Tax Refund For Dior Bag Bragmybag

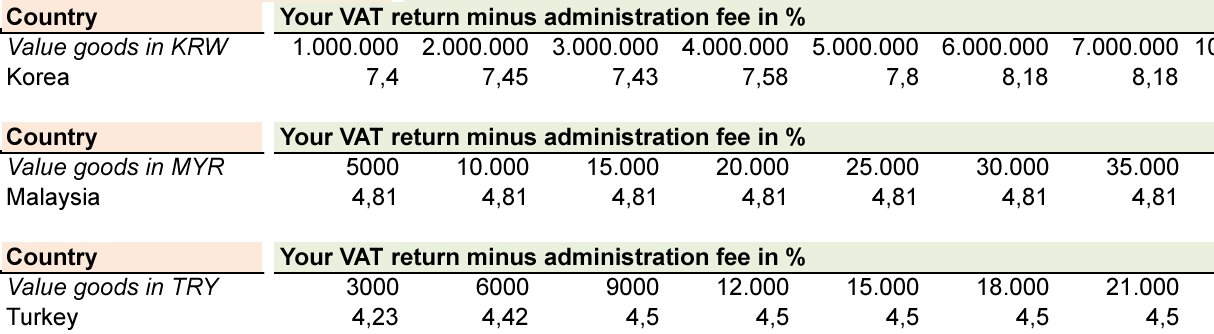

Where To Find Highest Tax Refund For Dior Bag Bragmybag

Guide To Tax Refund In China Bragmybag

Tourist Using Self Service Kiosk Gst Refund At Changi International Airport Terminal 4 Singapore Stock Photo Download Image Now Istock

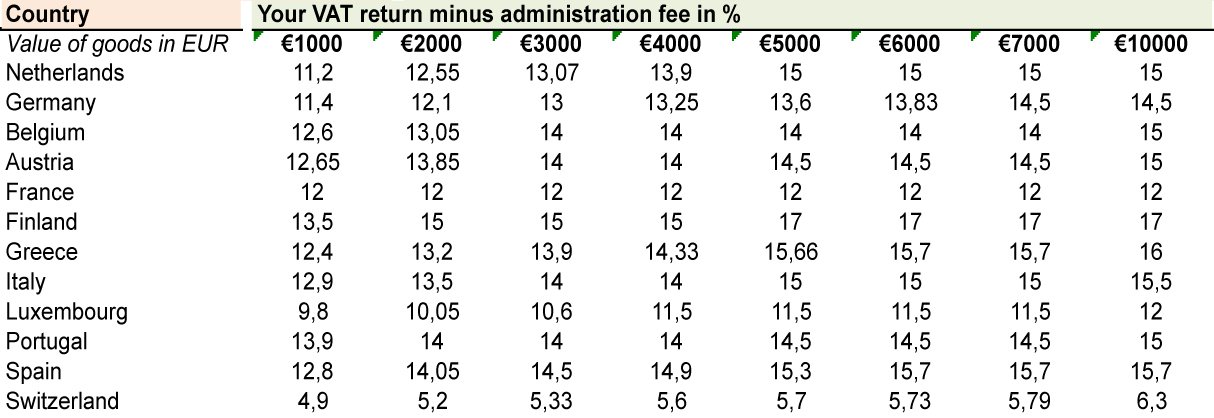

Quebec Moves To Tax Digital Goods And The Virtual Marketplace Tax Authorities Canada

Guide To Tax Refund In Malaysia Bragmybag Tax Refund Bags Bags Designer

Tax Refund For Tourists Youtube

Working Out Your Gst Return Gst Guide Xero Sg

Where To Find Highest Tax Refund For Dior Bag Bragmybag

Private Transport Service Singapore Airport Cruise Luggage